November 20, 2023, is the day the United Auto Workers (UAW) union announced they had reached a deal with “the Big Three” – Stellantis, Ford, and General Motors – to end a 6-week strike that cost these automakers billions of dollars in profits.

It’s also a day that should strike fear into the hearts of manufacturers across the country and states that have turned an anti-union labor posture into a siren song for foreign automakers and their suppliers. As a result of negotiations, the UAW was able to secure a 25 percent pay increase through 2028, the annual cost of living adjustments, the ability to strike over future plant closures and other concessions. By any measure, it was a sound victory for organized labor.

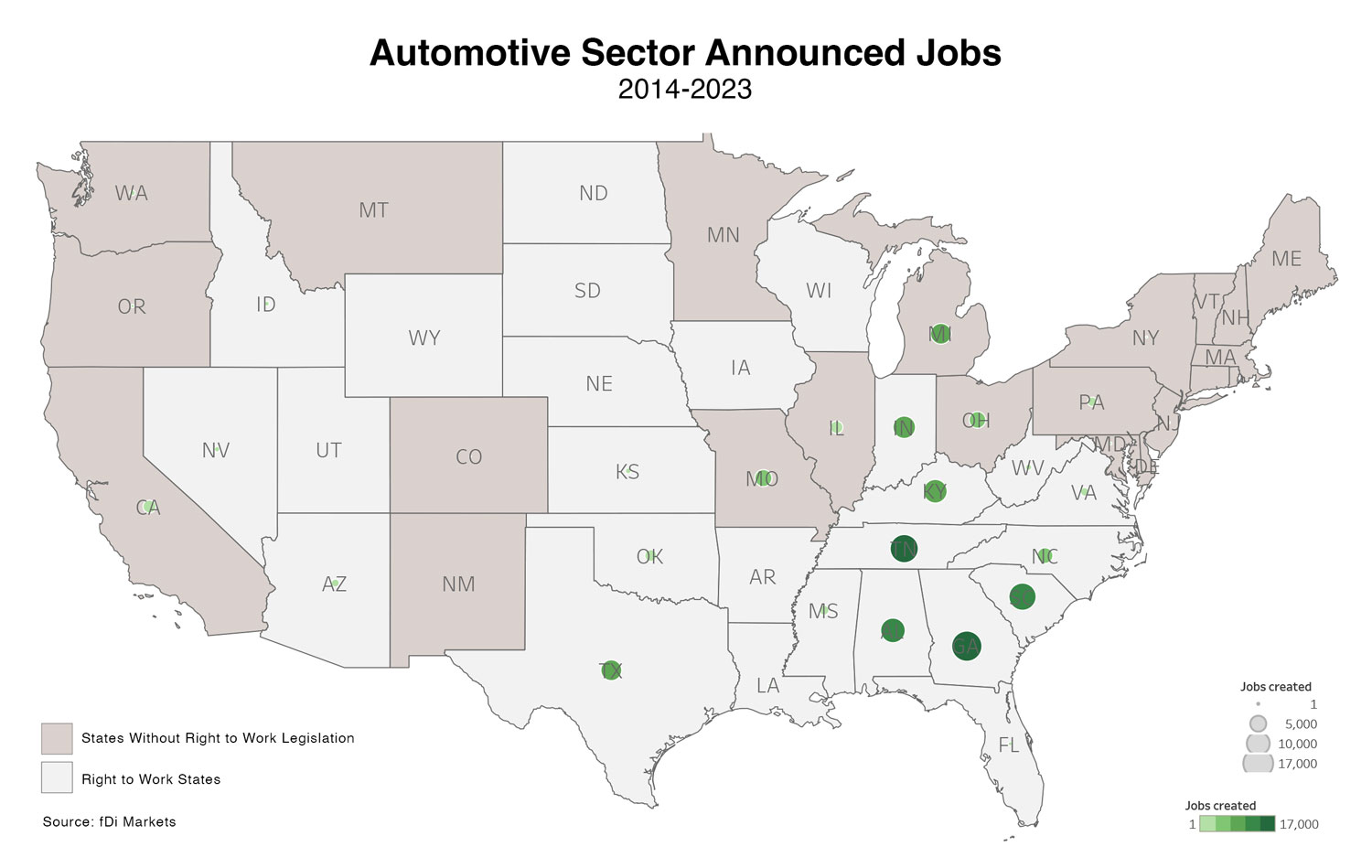

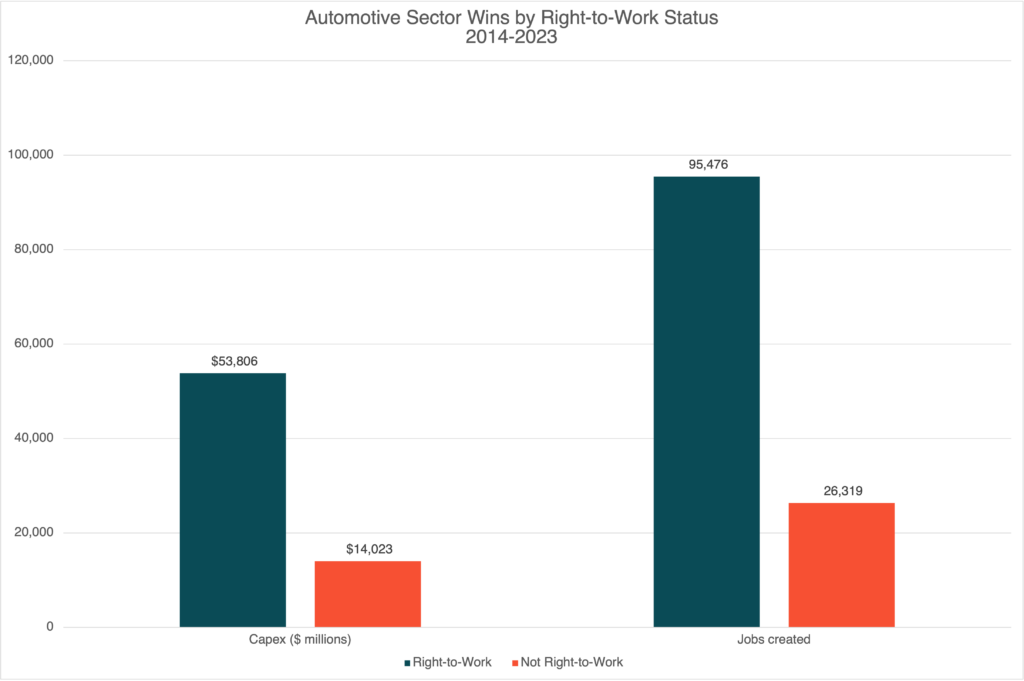

The ink was barely dry on the contract when UAW leadership, emboldened by their success, set its sights on the entire non-union automotive workforce including operations at BMW, Hyundai, Mercedes-Benz, Nissan, Rivian, Tesla, Toyota, and Volkswagen. Many of these operations are in Southern, right-to-work states that have recruited mostly foreign automakers and their suppliers over the last several decades based on lower wages and more freedom from union contracts that are widely regarded as inflexible.

UAW victories at these plants are far from certain. Since the days of the textile mills in the South where preachers warned from the pulpit about the dangers of unions, Southern states have regarded unions with something between suspicion and outright hostility. Nikki Haley, then governor of South Carolina and now a GOP candidate for President, was famously sued for vowing to fight the machinist union that attempted to organize the Charleston Boeing assembly plant in 2011.

But even if the UAW’s attempts are unsuccessful, there are three reasons why its deal with the Big 3 represents a dramatic shift of power from management to labor and merits closer watch by US manufacturers.

Reason #1: Organizing Attempts Can Impact Cost and Productivity

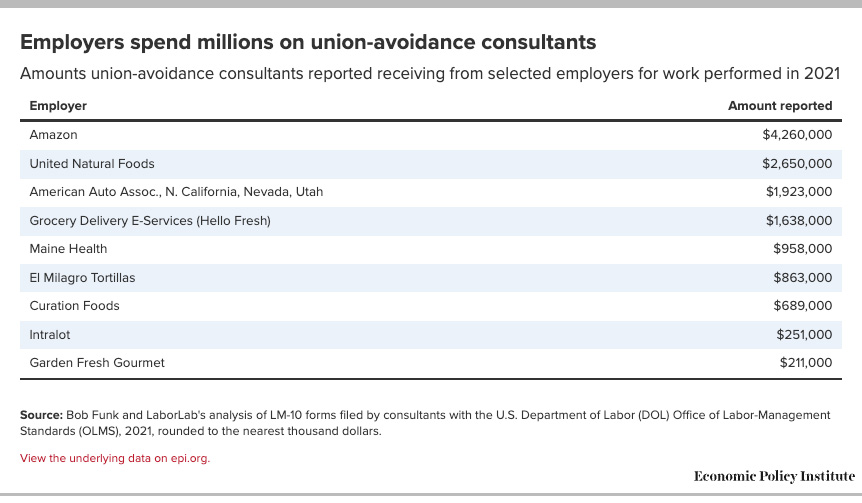

No doubt about it, union organization attempts and the fights to defeat them are costly. According to the Economic Policy Institute, an independent, nonprofit think tank that researched the needs of low- and middle-income workers in economic policy discussions, companies spend an estimated $433 million a year on consultants that specialize in “dissuading” workers from organizing. Amazon alone spent a reported $4.26 million in 2021 alone.

And that’s just the tip of the iceberg. A significant amount of management time and energy is focused on addressing labor relations during a campaign. Companies tend to resort to the union-busting playbook, which includes above-board tactics such as mandatory anti-union meetings and posting anti-union materials; and some questionable maneuvers including making veiled threats about layoffs, sowing doubt and division among employees, denouncing unions in daily interactions, and interrogating employees about their views. At best, workers are distracted and less productive. At worst, morale suffers, turnover increases, and costs soar even higher.

Reason #2 Ongoing Union Avoidance Costs Will Rise

In response to the UAW’s success, non-union manufacturers are proactively looking for ways to avoid being targeted in the first place. As always, companies can keep their employees more engaged through non-financial means; but, now more than ever, competitive wages are in the spotlight. In the days leading up to and since the deal was struck, Honda, Hyundai, Nissan, Subaru, Tesla, Toyota, and Volkswagen have all announced wage hikes for their US workforce that range from a low 9% up to 25% by 2028.

According to a whitepaper from the Center for Automotive Research, these automakers plus the Detroit Three accounted for more than 87 percent of US motor vehicle production in 2023. In a nutshell, everyone is getting a substantial raise – either from organizing and negotiating a great deal or because their employers wanted to avoid a union-led deal.

The cost to consumers may go up. However, much of these costs are absorbed by companies, and profit margins are the real casualty. When money gets tight, companies tend to tighten their belts and reduce project investments with a lower risk-adjusted rate of return. This could spell trouble for the recent billions of dollars in announced projects for the production of batteries and electric vehicles, largely concentrated in the South, where faltering demand and supply chain concerns are creating uncertainty.

Reason #3 An increase in competition from lower cost, foreign manufacturers

Finally, increased costs could lead to higher competition from foreign manufacturers. While high-profit segments such as trucks and SUVs may continue to be manufactured in the United States, other segments could be outsourced to countries with lower costs. Compared to model growth of 6 percent in the US, Canadian and Mexican auto output increased by 28 percent and 16 percent, respectively. That shift could represent a longer-term trend where a higher market share of production is concentrated outside of the US, further eroding the economies of scale present in today’s US automotive sector.

The Last Word

If Southern states can fend off the UAW’s efforts, as they have successfully done in the past at Nissan in Mississippi and VW in Chattanooga, they will retain the ability to use this as a recruiting tool for automakers and manufacturers in any sector. This could further strengthen the South’s market share in winning competitive manufacturing projects.

Success is far from guaranteed. In August 2023, workers at Blue Bird, an electric bus manufacturer in rural Georgia, joined the United Steelworkers; and rising victories in other sectors across the country have emboldened the labor movement as it sits today. Manufacturers across the South are taking notice and need to be on the offensive. Competitive pay and benefits that rival UAW’s wages, a culture that engages and empowers employees, and the reduction of temporary workers who have fewer rights will all help avoid dissatisfaction that makes workplaces vulnerable to organization attempts. After all, they say the company that gets a union is the company that deserves one.

Written by Didi Caldwell, President + CEO